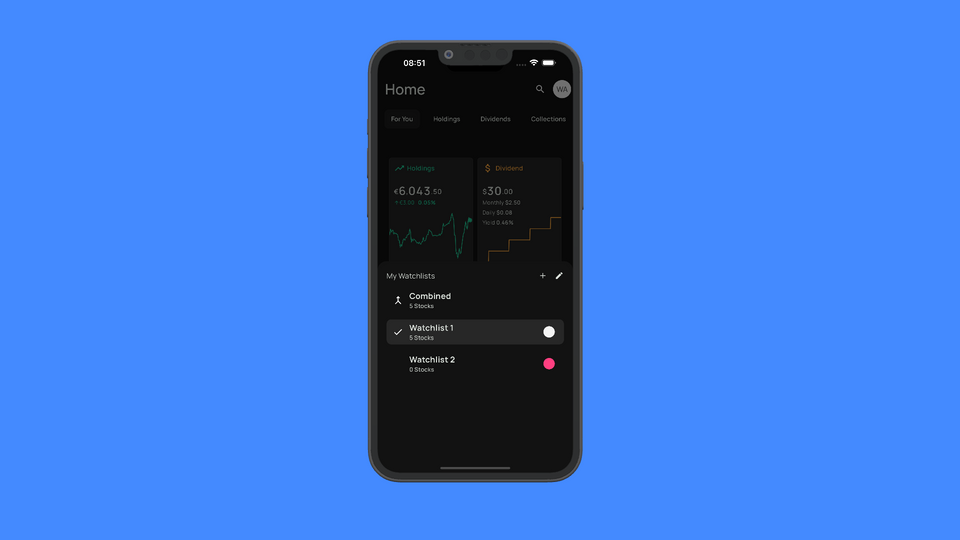

Since the first day, we've added a variety of stock events to your feed to help you keep a better track of everything that's of interest to you regarding your investments.

Some of these events, particularly two, can be spammy at times, making it difficult to see the really important events. With these changes, we aim to improve the event feed for you.

Goal: To only show what's truly important

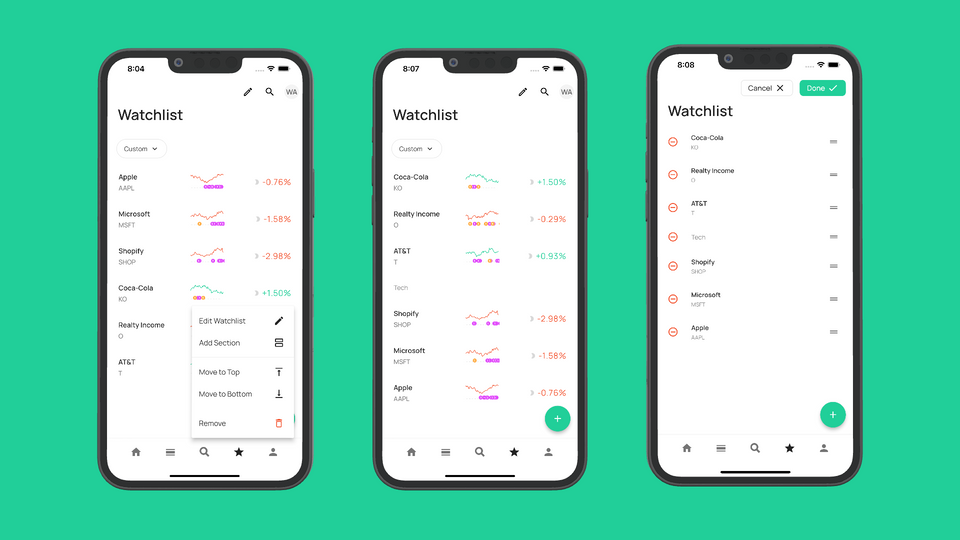

Dip Events

A dip occurs when a stock reaches a certain price that is below its usual movement upon retrospective analysis.

Recently, the stock market has experienced intermittent downward trends, leading to a surge in dip events. This is because we were showcasing one dip for each day a stock was in a dip.

Changes to Dip Events

Moving forward, we will only display dip events on the first day a stock enters a dip phase.

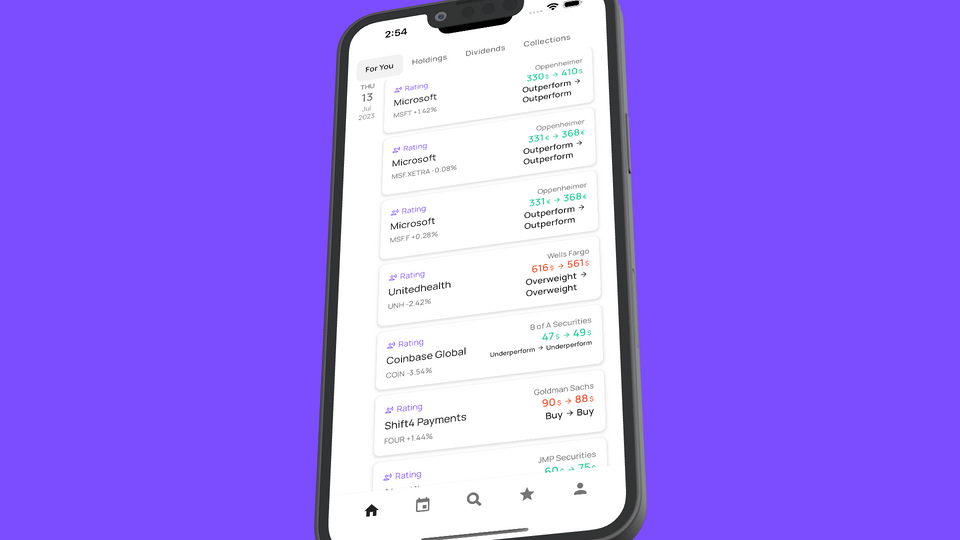

Rating Events

Whenever a stock analyst alters the rating for one of your subscribed stocks, we generate a rating event.

Unfortunately, many analysts modify their ratings simultaneously when significant incidents occur, such as earnings calls or important news. On these days, you might notice numerous rating events for the same stock, which dilutes the quality of your feed and triggers an excess of notifications.

Changes to Rating Events

In the future, we will display a single consolidated rating change per stock per day. This means we will only show how the average price target of all analyst ratings shifts or if the consensus stock rating changes (from hold to buy, for example).