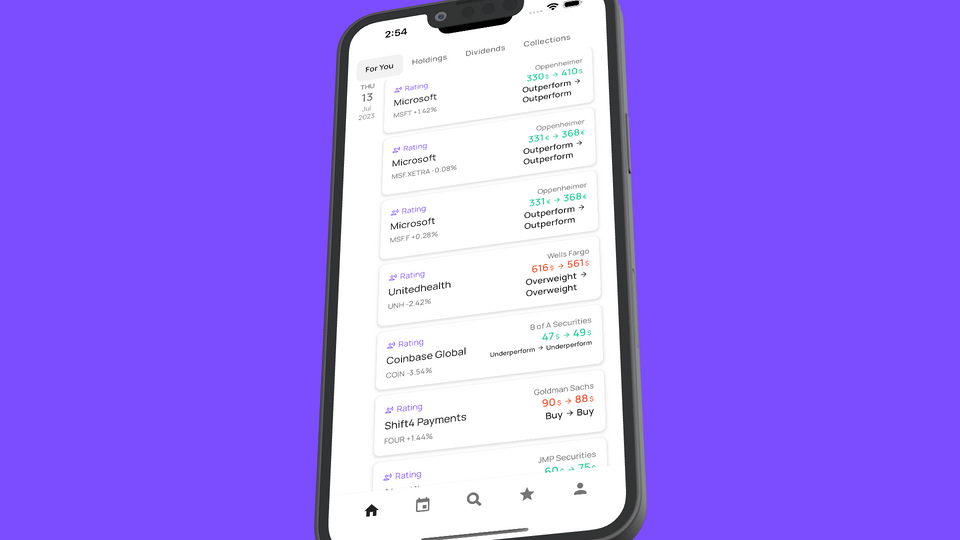

A good Dividend Tracking App has the ability to predict future dividends. That's necessary to calculate your real dividend returns.

To understand why it's important we can take a look at the Apple stock.

If we take the latest 4 quarters and use that to calculate our annual dividend return, we get 0.22$ + 0.22$ + 0.22$ + 0.23$ = 0.89$ in dividends. If we multiply it by 100 shares we get 89$ in annual dividends. That value however is wrong if we want to look at our actual annual dividend return.

For the correct value, we'd have to predict how future dividends look like.

The easy cases

Fortunately most cases are easy, because they fall into these categories.

Steady frequent dividends

Most companies and ETFs fall into this category. They pay a quarterly dividend which increases once a year. In this case we can take the latest amount und spread it out over the next quarters. For the example above it would mean 0.23$ + 0.23$ + 0.23$ + 0.23$ then multiply it by 100 shares and we get the actual annual dividend return of 92$.

Yearly Dividends

We can just take the latest confirmed year, multiply it by the 5 year average dividend growth rate and get the next dividend.

The not so easy cases

Some cases are not easy and we need different approaches to predict future dividends. Here are some of those.

Very irregular dividends:

| Symbol | Pay Date | Amount |

|---|---|---|

| ING | May 2022 | 0.24$ |

| ING | Apr 2022 | 0.43$ |

| ING | Oct 2021 | 0.55$ |

| ING | Feb 2021 | 0.15$ |

| ING | Aug 2019 | 0.27$ |

| ING | Apr 2019 | 0.49$ |

Hard to predict how future dividends will look like here. We have a year of not paying dividends at all and generally very irregular amounts and payment dates. In cases such as this, it's probably best to copy the previous year and use it as is. Maybe apply dividend growth rate as well.

One very high dividend

| Symbol | Pay Date | Amount |

|---|---|---|

| QQC-F.TO | Jun 2022 | 0.21C$ |

| QQC-F.TO | Mar 2022 | 0.23C$ |

| QQC-F.TO | Dec 2021 | 2.88C$ |

| QQC-F.TO | Aug 2021 | 0.24C$ |

| QQC-F.TO | Jun 2021 | 0.24C$ |

Sometimes companies pay a very high irregular dividend. To not have them mess up our dividends we have to somehow identify them as irregular and remove them from future predictions.

Some companies however do indeed pay one very high dividend every year. We cannot remove them from our calculation as well. In cases such as this, we need to look at a very long timeframe to determine if it is truly an irregular dividend.

Changing the payout frequency

Sometimes companies change their payout frequency. For example from a monthly dividend of 0.14$ to a quarterly dividend of 0.42$.

These cases are almost impossible to predict with just one confirmed quarterly dividend. We need at least two confirmed quarterly dividends to be able to notice a change in frequency.

Conclusion

Fortunately most dividend paying companies fall into the easy case category.

To calculate the annual dividend return for the whole portfolio as precise as possible, it's often necessary to handle the tough cases as well.

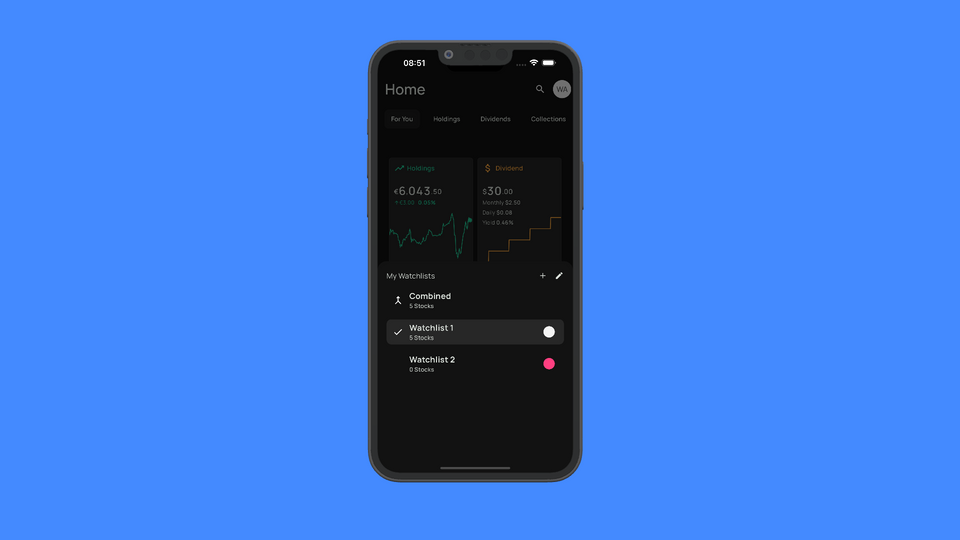

At Stock Events we constantly work on improving the prediction algorithm. Please let us know if you have any feedback.